Hey, I’m John Grimshaw!

I’m Smart Marketer’s Chief Marketing Officer, and before that I spent 5 years at DigitalMarketer building up their data program.

And here’s a fun fact about me: I really, really love data. That may not sound “fun,” but read this whole post before you decide. 😉

I’ve found that while most businesses can get to $1-5 million in annual revenue with grit and a good hook, it’s really hard to make the jump to the next tier — to the $10–50 million range — if you’re not measuring data correctly.

That’s why in this article I’m going to show you how to use data to make more intelligent and more profitable decisions in your business. (Don’t worry, I’ll keep it simple.)

I’m going to show you:

- How much you can actually afford to pay for a customer

- The amount of financial risk your business can handle (ranging from low to Tom Cruise)

- How to calculate and use Lifetime Customer Value

- The number I like to use instead of LCV, and why

- Real-world examples of how I used data to generate more profit for my clients

Who Cares About Lifetime Customer Value?

You’ve probably heard the term Lifetime Customer Value (LCV) thrown around once or twice, but what is it and how do you use it?

First thing’s first: why should you even care?

To answer that, take a look at this post from the Facebook group of Smart Marketer’s private Mastermind:

19 comments is pretty high for this group. So why are a bunch of 7–9-figure business owners chatting it up about LCV?

2 reasons: It’s super important, and most people don’t understand it.

4 Variables that Impact Lifetime Customer Value

When we talk about LCV, we’re trying to understand where to spend time and dollars. Where should we optimize our pages, or change our front-end products? It’s all about attracting customers that will stick with us for a long time.

There are four factors that influence a customer’s overall value:

- Order Frequency: How often are people going to come back and buy?

- Average Order Value: What is an average order worth?

- Customer Lifetime: How long is a customer actually a customer? At some point they’re going to leave and stop buying our products — is that in 1, 3, 5, 10 years?

- Sales Margin: Don’t just think about what you’re making in terms of revenue, but also in terms of profit. Once you understand the profitability of your different customers, then you can change how you invest money in traffic platforms, who you speak to on your website, and optimize your marketing in general.

Okay, good… But how do you calculate it?

2 Methods for Calculating Lifetime Customer Value

Here are 2 equations you can use to calculate your LCV:

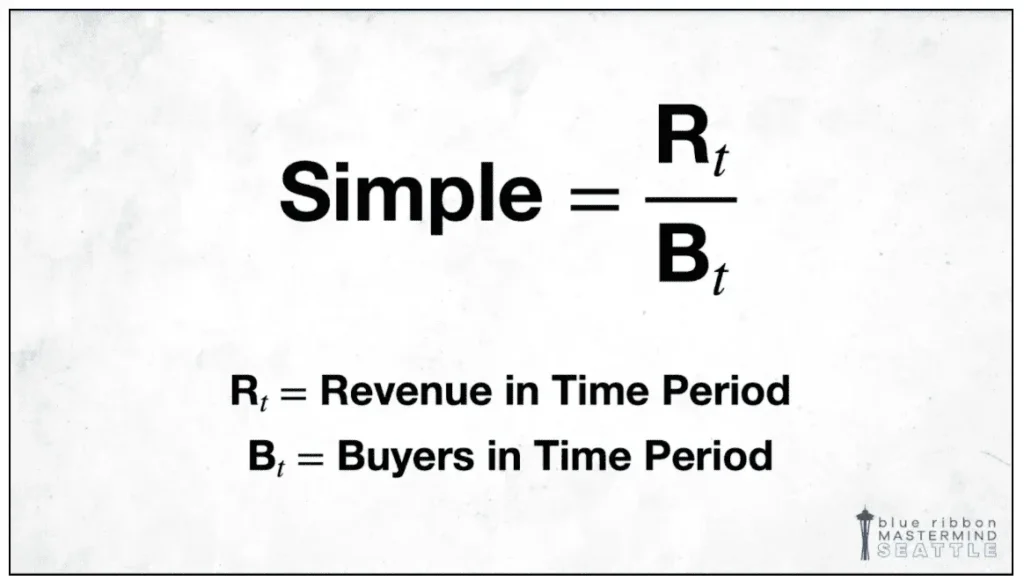

1. The Simple Equation

The easiest way to calculate LCV is to divide the amount of revenue captured in a time period by the number of buyers in a time period. (This equation uses only revenue, not profit.)

So if you bring in $100,000 in three months during which you had 1,000 buyers, then on average your customers are worth about $100 in these 3 months.

It’s tempting to extrapolate this and say, “Well if my customers are worth about $100 in 3 months, then I can go spend $400 to acquire a customer and I’ll make it back in a year.”

Unfortunately, that’s a really bad idea. I’ll explain why.

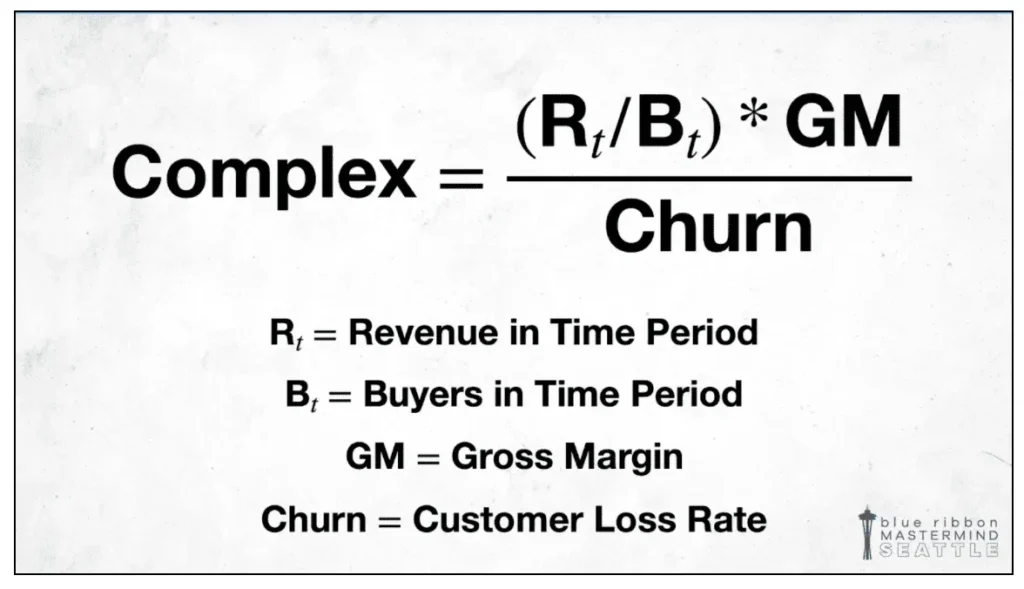

2.The Complex Equation

The more accurate method is to take the figure we got from the simple equation and multiply it by gross margin and then divide it by churn.

Churn can be difficult to define and it varies business to business.

For most SaaS businesses it’s easy, because they bill monthly and you can point directly to the time when people fall off.

But if you’re selling skincare products like BOOM!, a customer might take 60 days to finish a product then wait 30 days until they buy again. So there’s a 90-day interval where they don’t purchase, and during that window you don’t know if they’ve churned or if it’s just the natural window between purchases.

How I Found Hidden Customers That Were Extremely Valuable

While working at DigitalMarketer, I was reviewing our sales funnels on Facebook.

Facebook was our biggest traffic source (we drove hundreds of thousands of dollars every couple of months) so I wanted to see which campaigns were generating the most profit.

In one funnel, we were promoting a free 6-week course as a partnership with Infusionsoft.

We weren’t doing this to make money – it was part of a partnership with a well-known CRM where they put the ad spend up and we created the funnel. We threw our own $2,000 offer at the end of the 6 weeks with the thought that, “Hey, if we make a sale or two that’s great. If not, it’s about the business relationship.”

Later, when I dug into the data, I realized the average customer value after 6 months was $278. Meanwhile, the average order value for our regular funnels (the ones we were putting most of our money behind) was only $128 after 6 months.

So it turned out that this funnel — which we never thought about in terms of profit — was delivering really valuable customers over time.

And in addition to having a high LCV, this funnel also had good margin: we were getting leads for about $6 then making $14 per lead.

We ended up going back to Infusionsoft to ask if they wanted to spend more money with us, and no surprise — they did!

Point being: by looking at customer value over time, we found an opportunity to invest more money in a really profitable offer.

Why Lifetime Customer Value is Bullshirt

As an exercise, In 2004 KISS Metrics and Avinash Kaushik (the godfather of web analytics) wanted to calculate what an average customer was worth to Starbucks.

So they took a ton of sales data and ran it through 3 different equations, and they came up with a range between $5,500 and $25,000. Then they averaged it together and came up with $14,099.

So theoretically, Starbucks could spend $13,900 to acquire a customer and still make $100 in profit over the customer’s lifetime (not that they would).

This is why LCV is, ahem, bullshirt. (a Good Place edit for karmic reasons)

Here’s why: they arrived at these 3 very different numbers using 3 very different equations to calculate LCV. But technically, none of the 3 numbers are wrong.

This might work as a thought exercise… but personally, I don’t want to make decisions about my business knowing that I can spend either $5k or $25k to acquire a customer. It’s too big of a range to really be a smart player.

The Metric I Use That Beats Lifetime Customer Value

So you can see the problem with LCV: it’s wildly imprecise. And when you’re making a prediction about the future that you’re trying to use today in your business, that’s dangerous.

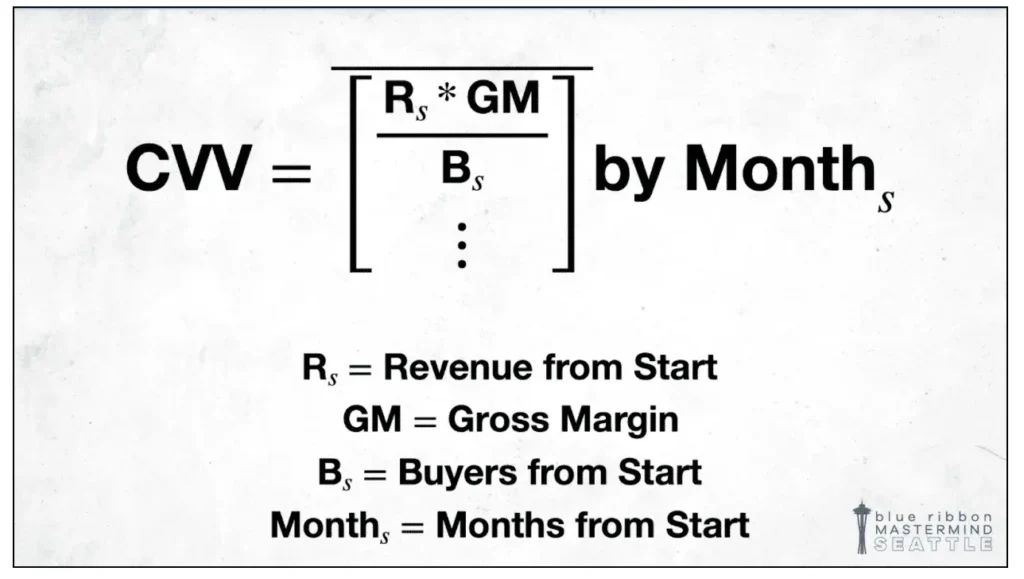

So instead of LCV, I use this metric I coined: Customer Value Velocity (CVV).

CVV measures how quickly value is added to your business by a customer.

Instead of focusing on the customer’s lifetime, this formula determines how quickly customer value increases: what is a customer worth in 90 days, or in 6 months? Then we can make marketing decisions based on that data.

To calculate CVV, you take the profit divided by the number of buyers, averaged out by cohort (I use the month they became a customer).

This doesn’t mean you should never talk about LCV. There’s a time and a place for it, but as someone who cares about data, I find CVV to be a much more useful metric to use day-to-day in my business.

I’ll explain why.

“Velocity” Provides a Trajectory of Growth for Your Business

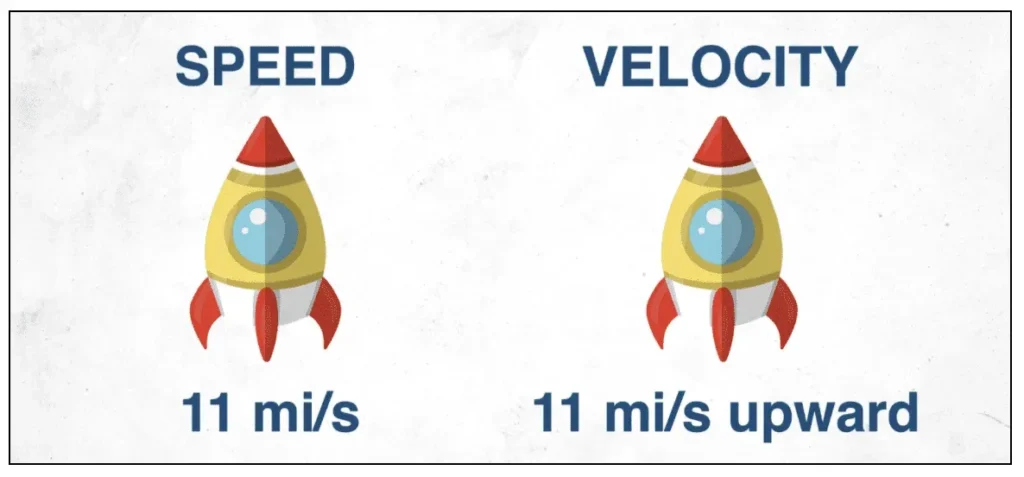

Here are 2 different numbers you come across in physics:

- Speed – For example, a rocket has to move at 11 miles per second to escape the gravitational pull of the earth. But with speed you don’t know which direction you’re moving. You could be moving straight toward the ground (and according to expert physicists, that would be bad).

- Velocity – This is speed plus direction. Following the same example, velocity tells you that not only are you moving 11 miles per second, you’re heading up and out of the earth’s atmosphere (that’s good!).

And that’s why I use the term velocity: CVV gives you a trajectory of growth for your business.

It isn’t a metric that just sits, or a single number. It’s a track, a growing line that I (and you) can use to make informed decisions

Example: How I Determined a Client’s Customer Value Velocity

I found a really interesting use case for CVV while working for a client. This part gets a bit math-y, but if you’ll stick with me you are going to be amazed at how powerful Customer Value Velocity can be.

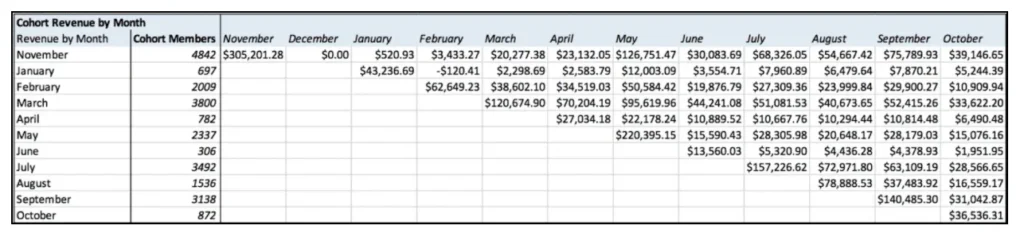

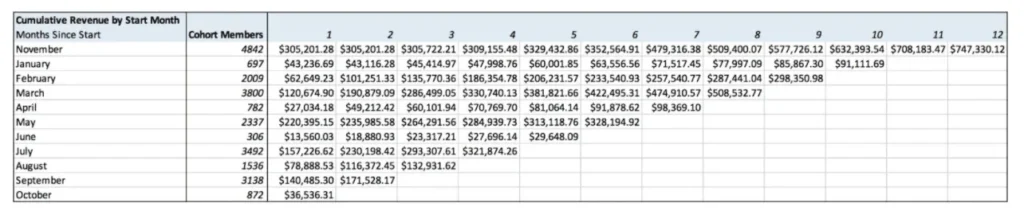

First, I tied all their sales to the month when someone actually became a customer. For example, people who became a customer in November spent $305,000 that month, then in May they spent another $126,000, etc. I did this for all months we’re looking at.

Then I changed it so instead of showing the month the revenue came in, it’s the month in relation to when they started.

Next, I made it cumulative. So by month 6 the people in the November group had spent a total of $352k. I took all that and I broke it out by how many months it’d been since their purchase.

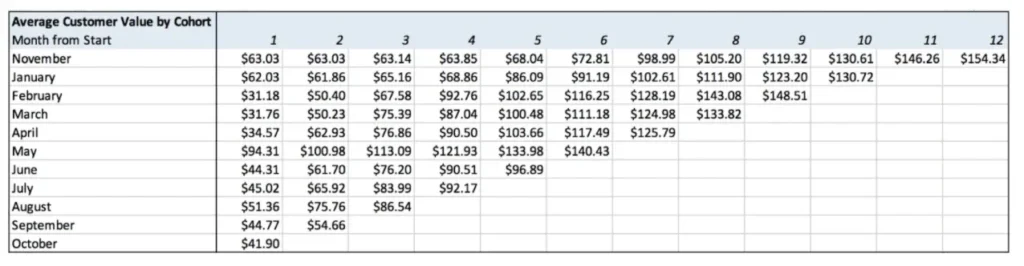

Then, I divided that revenue/profit value by the total number of people, which gave me the average value a customer is worth X months from when they started.

So in month 7, for example, the November cohort was worth about $99 and the March cohort was worth about $134 — that’s a pretty big difference!

Lastly, you want to average this out, and by averaging it out you get the customer value velocity — i.e., how value is added by customers from the point they start through their lifetime as a customer.

So after 3 months, these customers were worth about $79 on average.

How to Use Customer Value Velocity to Determine Your Maximum Acquisition Cost

Once we understand how to find this metric, there are a ton of really cool ways to use it.

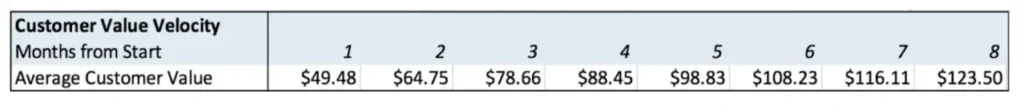

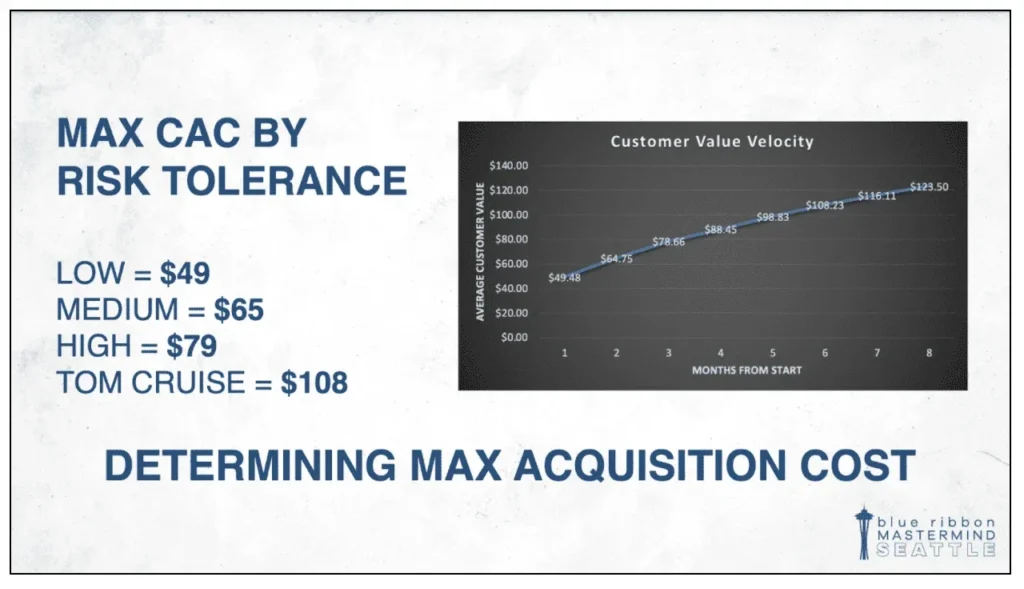

First and foremost, you can use CVV to determine your maximum acquisition cost.

Yes, this is technically the most you are willing to pay for a customer, but it’s also your willingness to take on risk as a business.

For example: if you’re a new business without a lot of money, your risk tolerance is probably low. You could acquire customers with a max cost of, say, $49, because that gives you 30 days from when you acquire a customer to make all my money back.

Or maybe you’re a little more established, so you can go 2 months before you need to make all your money back. At a medium risk tolerance you can spend $65 to acquire a customer, which means you can scale faster than someone who can only spend $49.

Maybe you can take on high risk and you can save 3 months out, or maybe you’re Tom Cruise from Risky Business and you can wait 6 months to make your money back. If so, you can pay as much as $108 for customer acquisition.

The reason why your risk tolerance is so important is because when you can spend more to acquire a customer, you can:

- Invest more in your branding ads.

- Compete for the top spot on Facebook, Google, really any traffic channel.

- Do a market ‘land grab’ and become the strongest brand in the market by acquiring many customers quickly, at a loss. You spend more today, but you build the customer base for tomorrow.

What happens when you don’t understand risk tolerance?

You might spend too much, meaning you take on too much risk and put your business in danger…

Or you might not spend enough, causing yourself to scale slowly and lose ground to competitors in your market.

Segmenting Different Products with CVV

You can also do some really cool stuff when you start to segment this data (instead of using an average like I did above).

Choosing Front-end Products

The example business above had both single-pay and subscription offers.

Over 4 months, those single-pay buyers of Product A were worth an average of $61, while the people who bought subscriptions were worth about $103, making them 67% more valuable.

Duh, right? Obviously subscription is better than single pay. Let me explain…

I compared the Product A subscription offer with another single-pay products, lovingly named Product B, and the single-pay customers were worth 22% more after 4 months.

So for this business, the most profitable front-end offer for their traffic channels is actually the single-pay Product B, not the subscription Product A. Those buyers spend more and are more likely to buy again in the future.

Choosing Discounts

In addition to choosing the best front-end products, CVV can also help you choose the right discounts.

Is 10% off the right offer? Maybe giving people 30% off would increase conversions, but would those buyers be less profitable over time?

When you segment data like this, you get a better understanding of that transformative moment when someone goes from website visitor to customer.

Then you can track how their lifetime value changes and figure out what you should do on the frontend to acquire your most valuable customers.

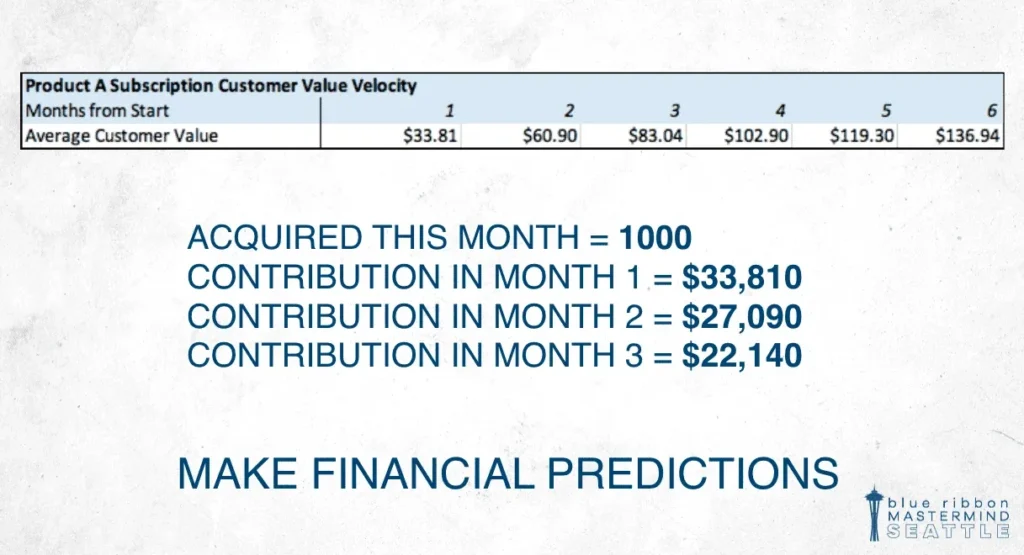

Using CVV to Make Financial Predictions

You can also use CVV to make financial predictions. This is fun and I love doing it.

If we know our CVV for buyers of subscription Product A, then if we acquired 1,000 customers this month not only did we already make $34,000 from this cohort, we know we’ll make roughly $27,000 from them in month 2 and $22,000 in month 3.

That means we can start to forecast when money will come into our business.

If you know that in 3 months you’ll have X amount of funds coming in, then you can plan your next big marketing push to coincide with that big influx of capital.

You can use this data to plan:

- Inventory Purchases

- Product Launches

- Big Holiday Ad Spending, etc.

So now when you get new customers you won’t only be thinking about the sale you just made; you’ll be thinking about those customers as investments.

CVV is all about helping you make strategic business decisions that will help you scale.

Now that you know the value of a customer over time you can invest in your customer acquisition process, which is the best thing you can do to grow your business. And you can make decisions intelligently without worrying about spending too much or too little.

Avoiding the Danger Zone: 4 Important Things to Remember About CVV

I’m not telling you to go spend a bunch of money and make dangerous decisions about your business.

I wouldn’t want to send you — like Tom Cruise in Top Gun — on the highway to the Danger Zone.

So here are 4 things I beg you to NOT forget:

- CVV is not linear.

It changes over time, so don’t assume that because a customer is worth $100 after 3 months, they’ll be worth $200 after 6 months. That’s not how it works. Sometimes buyers plateau, sometimes they spend more than you expect. You need to actually map the graph for your business - Revenue does not equal profit.

When doing this calculation, don’t say “I made $200,000 in revenue so I can spend that much money.” No, you want to make sure you’re using profit. Take out all the variable costs — shipping, goods sold, etc. — to make smart decisions that don’t multiply your losses. - Understand your level of risk tolerance.

If you’re a new business, you might not be able to wait 6 months to break even on a customer. Know what your cashflow looks like and map that to how much risk your business can take on. - These values are relative, not absolute.

CVV changes constantly, so make sure you recalculate this data regularly. Try to pull it once a quarter. You want to make business decisions with the freshest, most up-to-date data you’ve got.

Tools You Can (and Can’t) Use to Calculate CVV

Lifetimely

I’m very bullish on this tool. It integrates with Shopify, and it’s awesome because it lets you filter by the first product customers bought, the traffic source they came in from, what product category they bought, all that kind of stuff…

ChartMogul

This one is more for SaaS than for ecommerce. It’s a little inflexible, but it’s great if you’re working in SaaS.

Google Analytics (Don’t Use!)

I love Google Analytics, but their LCV tool is garbage. It only shows you the last 90 days (and remember, CVV is so powerful because it shows you value over time.) So do not, under any circumstances, create projections about what you should be paying to acquire a customer based on data from Google Analytics.

Manual Calculation

This works great if you’re up for it. Just refer to the equations above and you should be in good shape!

This has been John Grimshaw — thanks for reading!

John Grimshaw is the Chief Marketing Officer at Smart Marketer and an expert in data and analytics.

As an educator, John teaches marketers how to track and analyze data so they can make more informed business decisions.

He’s also the former Marketing Operations Manager for DigitalMarketer and a Co-Founder of DigitalStrategyBootCamps.com, where he specializes in website analytics and KPI management.