Welcome to Part 2 in my 3-part series on money management for small business owners and entrepreneurs.

If you haven’t watched Part 1, you can find it here: Money Talks (Part 1): Confronting the Money & Setting Financial Goals.

In the first video, I share how I set healthy financial goals for my businesses and my personal life, and explain the reasons why most entrepreneurs go broke at least once in their career.

In this video, I show you the financial reports I look at every month to spot trends, avoid costly mishaps and get a high-level view of the health of my business.

(By investigating these simple reports, I was able to spot and correct an error that saved my business $1 million this year alone. More on that later.)

I created this series because most people talk about how to make money, but not how to keep money.

That can lead to disaster for many early entrepreneurs, and if you aren’t looking at these reports then you are absolutely harming your business. No question.

But let’s start Part 2 on a positive note.

Enjoy Your Success Now

For those of you who are anxious about spending money, one to thing to remember is that now is the time to experience the success you are chasing.

My business partner passed away this year, and — not to get too heavy, but — it showed me that you never know how long you have.

That’s why I believe that if you have the resources to enjoy yourself, you should do so now, not later. In my opinion, you actually serve your team, your friends and your family better when you’re well taken care of.

Whether it’s time, money or energy, you can only give from surplus — if you don’t build up your surplus, then you limit what you can give.

You’re doing nobody a favor by working yourself into the ground and then having no energy left for your health and your relationships.

So why is this so common in our industry?

Because unfortunately, the mantra in our culture is hustle, grind, sacrifice… But if you want to work hard over a long period of time and not burn out, then you have to take care of yourself.

Remember MTV Cribs, Anyone?

When I say “enjoy your success now,” I don’t mean it has to be on a grand scale. Here’s a small example I like to give:

I grew up watching MTV Cribs. Remember that show?. You’d see celebrities’ houses and all the cool stuff they had…

And one thing I remember was that their fridges were always packed full of every kind of beverage imaginable — beverages I never saw at my house.

Since then I’ve always felt like “making it” meant having a fridge full of beverages. And my wife Carrie can tell you, I fill our fridge full of coconut waters, sparkling waters, and kombuchas…

So now every time I open the fridge, I’m like, “Dang, Ez… You made it!”

Take Care of Yourself (No One Else Will)

I have learned over the years that there’s a balance to be struck between saving money and spending it.

In my experience, it’s the people who don’t spend it — who err on the side of caution, tightness, and worry — who are always the ones not taking care of themselves.

Get a massage once a week. It’s not going to sink you.

You need to take care of yourself, because it actually ends up being the best thing for everybody.

Let’s do an exercise. (Okay, now this will get pretty heavy): What happens if you died tomorrow?

Are you happy with how you spent the last three months? Did you have experiences that you enjoyed? Did you spend time with your family and loved ones? Did you have fun?

That’s on you. Nobody’s going to do that stuff for you. You have to do it for yourself.

Set Aside 5% for Defensibility

Most people in their entrepreneurial journey at some point either go bankrupt or get way behind on their taxes.

That’s why in Part 1, my first tip was to have a goal for business liquidity and personal liquidity outside of your normal expenses.

If you can set aside the equivalent of 12 months of your business expenses and 2 years of your personal expenses, then you can protect against the worst possible outcomes.

I think of it like saving for taxes only instead of putting away 30% of the revenue, I set aside 5% to divide between business and personal liquidity.

That was tip number one.

My 3 “High-Level” Financial Reports

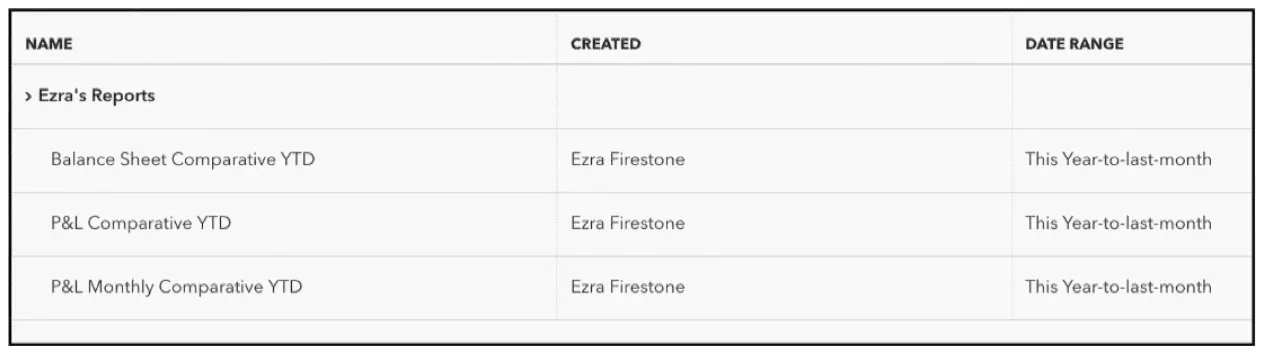

Tip number two is to get your accountant to create these 3 financial reports in QuickBooks, and show them to you every month:

-

1. Profit and Loss Comparative (Year-to-Date)

-

2. Profit and Loss Monthly Comparative (Year-to-Date)

-

3. Balance Sheet Comparative (Year-to-Date)

I’ll say it again: By not looking at this information, you are actively harming your business.

Don’t hand this task off to a CFO — look at them yourself, and if you have a financial strategist, get him or her to look at them with you.

Tip number three is to get your books done by the 10th of every month.

Hire a bookkeeper, pay them two grand a month or whatever, and make sure those books are done — every month, no exceptions, period.

So, by February 10, you should have January’s numbers done. Otherwise, you don’t have enough data to use in these 3 reports.

If you can’t get them done by the 10th — if you’re getting that far behind on your books — then something’s wrong.

Alright, let’s start with Report #1.

Report #1: Profit and Loss Comparative (Year-to-Date)

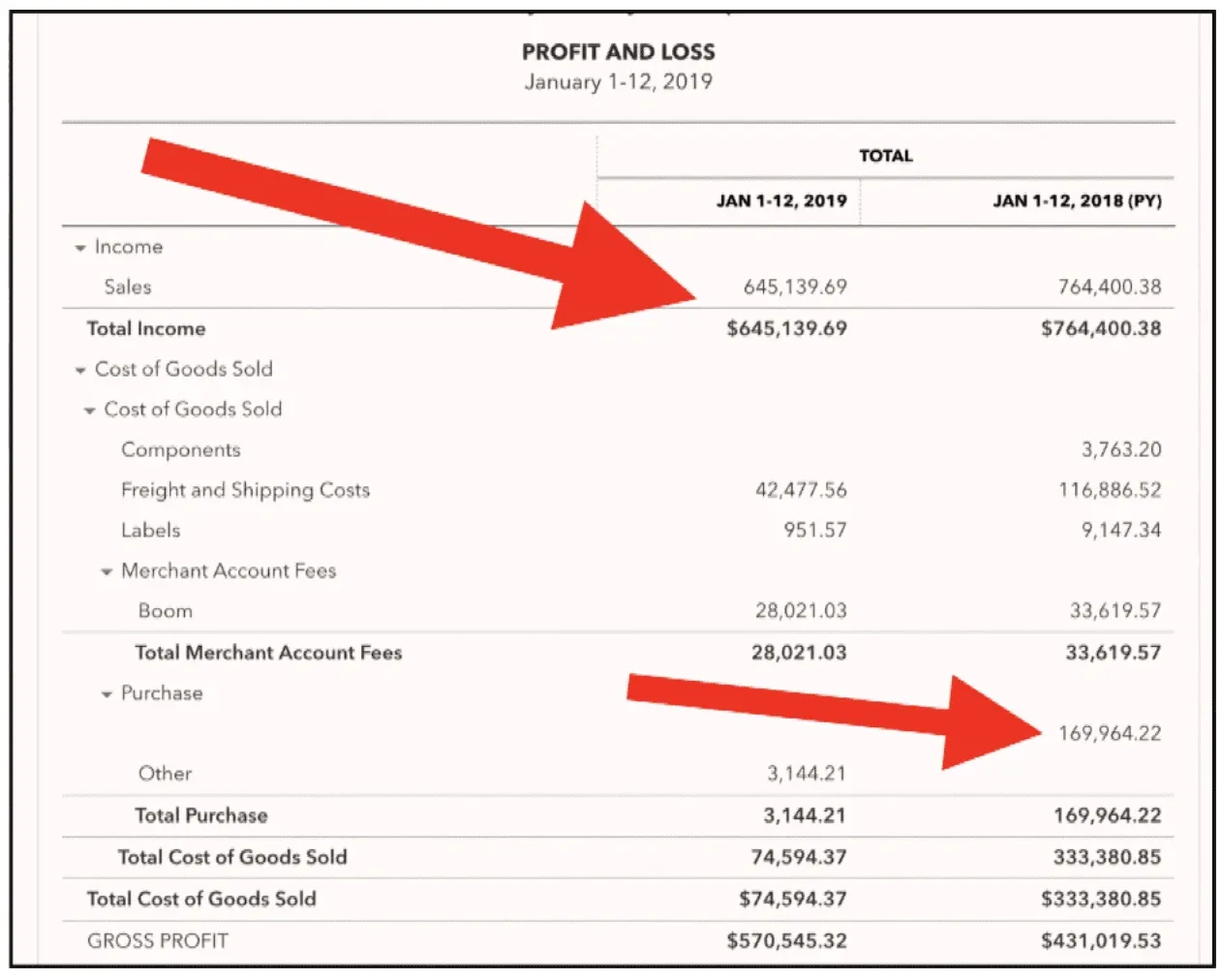

You’re looking at January 1-12, 2019 vs. January 1-12, 2018:

Total income: We had $645k this year vs. $764k last year, so we’re $100,000 behind where we were in 2018. This report is meant to highlight trends like this one so you can investigate and see what’s going on. Is it simply because I ran a sale this time last year, or do I need to dig deeper?

Total Purchase: You can see we placed a $169,964 product order this time in 2018, while we haven’t placed a big order yet this year.

Gross Profit: Because we don’t have an order on the books yet for 2019, we actually have more profit this year vs. 2018 even though we’ve made less income.

The $1 Million Mistake: Last year we spent $116k on freight and shipping for these 12 days vs. only $42k this year. That’s the $1 million difference I was telling you about. This report made it plain to me that something was haywire in the cost of shipping, and I was able to investigate it, find the error and fix it three months into last year.

No one else was looking that high-level, I only found it because of this P&L.

(Note: You can see that our cost of goods is nothing here. That’s because I have another report that breaks down the cost of goods separately. What the P/L shows is whether or not we purchased inventory in that time period. For your reports, it might make sense to include the monthly cost of goods, and that’s why you should talk to a CFO first.)

Okay, let’s keep going.

P/L Comparative Part 2: Advertising and Promotion (YTD)

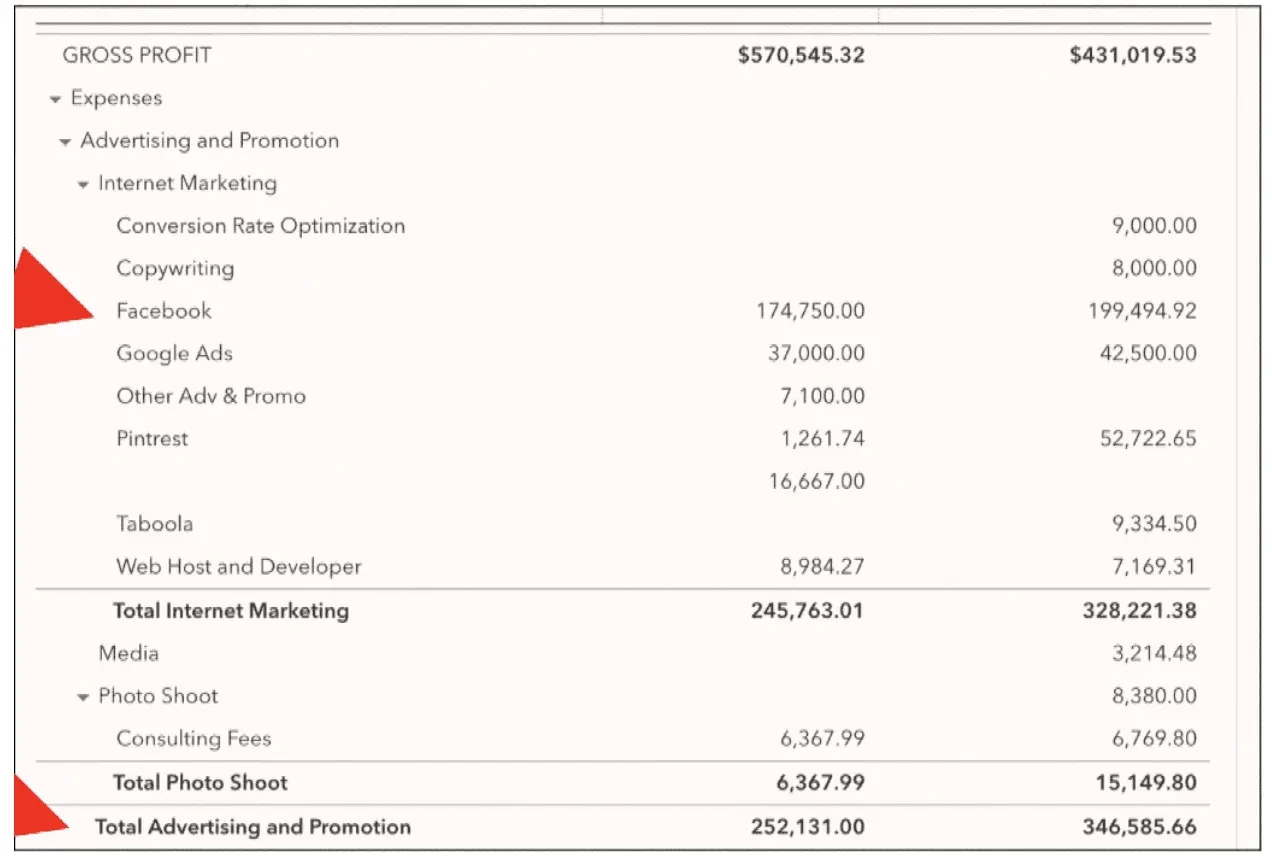

When looking at your Profit/Loss Comparative, it helps to look at advertising and promotion separately.

This report shows me how much we’ve spent in different ad platforms in 2019 vs 2018. So far, I can see that:

-

• We’re down in Facebook spend this year ($174k vs $199k last year)

-

• We’re down in Google spend ($37k vs $42k)

-

• We’re down in Other channels too ($16k vs $52k)

The P/L shows that so far we’re trending this year the same way we were last year.

Now, since my goal is to spend way more on Facebook and Google this year, when I see that the trend in the first 12 days is exactly what it was last year, then I know I’m already down and need to get that up.

Looking at the difference in spending on other platforms, I remember that at this point last year we were still running Pinterest ads, but since then we’ve stopped so I’m not worried about that.

Total Internet Marketing cost this year is $245k vs $328k. That tells me that we spent way less money on ads for a similar amount of revenue, and that we were wasting money on Pinterest ads.

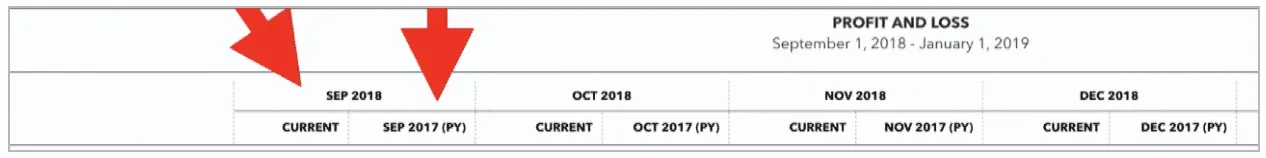

Report #2: P/L Monthly Comparative (YTD)

Now let’s move onto the second report I have my accountant whip up every month: The P/L Monthly Comparative (YTD).

Even though this is exactly the same financial information you use to create the yearly P/L, I highly recommend that you get your accountant to prepare this version for you as well.

This report is like having a zoomed-in version of your business to go along with the 30,000-foot view that the yearly P/L gives you.

It can be super helpful for spotting seasonal trends that affect so many ecommerce businesses. For example, you can use this monthly P/L to guide your spending around the holidays or optimize during slower summer months.

Now let’s move onto the balance sheet and the most important number to track in your business.

Report #3: Balance Sheet Comparative YTD

The final financial report I look at every month is a balance sheet comparing the total assets of the business as they’ve changed between this year and last.

(NOTE: Most of this information is too confidential to disclose, but I’ve included enough here to show you the most important part: How I use this balance to calculate my “net margin.”)

From Jan. 1 – 12, 2019 our “net income” was $227k (not taking into account the cost of goods), or to put it mathematically:

Total Revenue ($570k) – Total Expenses ($343k) = Net Income ($227k)

Net income is very important because this is the number that you (and your investors) use to determine the valuation of your business.

I’ll show you how.

The Most Important Number In Your Business

If you make $1 million in revenue and you have $100k left after everything (staff salary, cost of goods, cost of marketing, cost of shipping, etc.), that 10% you have left is known as your net margin.

And that number/percentage is the most important number in your business, period.

Here’s why.

Net Margin & Wealth Generation

One of my goals is to amass as much resource as I can in a pleasurable manner, because I have people I want to take care of and things I want to do.

If you study wealth, you’ll see that the people who generate large amounts of resource (money/assets) do so in “liquidity events” or “exit events.”

That’s why the private equity model is the business model with the highest return in our industry. These people buy businesses, operate them, grow them, and then exit them by selling for crazy multiples…

And net margin is what determines how much money your company sells for.

(Even if you never plan on selling your business, understanding your net margin is still important — especially if that number starts to drop.)

Tracking You Net Margin

If your company has investors and they see the net margin drop on your balance sheet, they’ll start to panic.

They’ll get on the phone, they’ll fly to your house, and they will freak out.

And you know what?

So should you. If you notice a trend where all of a sudden net margin is going down, down, down…

Something is wrong and you need to fix it, fast.

At the very least, you want to try to maintain a stasis year over year, but whether or not you sell the business, increasing your net margin is directly related to how much your business can grow.

Quick Exercise: How Much is Your Business Worth?

Here’s a quick-and-dirty way to use your net margin to determine how much your business would sell for.

Let’s imagine your businesses does $5 million in revenue at about $1 million in profit. That would give you a high net margin of 20%.

Typically, ecommerce businesses under $5 million sell for between a 2 – 6 multiple on their net margin.

So, in general, at $1 million in profit you would get between $2 million and $6 million if you were to sell.

Of course, this number will change depending on many factors, such as:

-

• Whether you’re selling to strategic buyers or financial buyers

-

• How much of that business is recurring or repeat business

-

• Whether or not you have multiple streams of customers

I love my business. I enjoy running it, and I will enjoy selling, too…

And since tracking my net margin every month helps me do both, I pay close attention to this report.

Mint.com for Personal Finances

Okay, so those are the three financial reports I get on my (standing) desk every month.

Another trick I use to help manage my money is Mint’s free tool to track and analyze spending.

Mint.com is a service that connects all of your personal credit cards and personal bank accounts, and gives you an on-demand data analysis of your purchases.

It’s like a P&L for your personal life.

(By the way, I’m not trying to tell you that you have to curb your spending — unless you’re one of those people who pulls out $600k from the business every year, in which case I might recommend you reinvest some of that.)

Speaking of Pulling Money From Your Business…

My tax rate is 48%, which is basically the highest tax bracket you can have.

Carrie and I make enough money to not get the breaks of the middle class, but not enough to get the breaks of the big corporations…

And this really affects how I feel about withdrawing money from the business.

For example, let’s say our business makes $1 million in revenue and $100k of that is profit that we get to distribute to ourselves. Of that $100k, I give 50% to the IRS, or about $50k.

In other words, if I generate $1 million this year at a 10% net income, at the end of the day I only keep $50k.

So, if you’re like me, when you spend money in your personal life, every dollar spent is $2 in profit that your business made:

$1 spent personally = $2 pulled from the business = $20 in revenue generated.

And who knows what your tax bracket is, but it’s definitely somewhere between 30% – 50%.

Once you know that, using Mint.com to do this exercise for your personal spending is pretty interesting.

And It’s Okay Not to Scrutinize Your Spending!

There’s an argument to be made for the other side of money management, which is, “Hey, man, let me breathe.”

You pulled this money out of your business, and you don’t want to feel anxiety about how you spend it.

And I totally get that!

Frankly, I lean more toward that thinking myself. That’s why I hired a CFO to look out for me.

The Benefits of Hiring a CFO or Financial Strategist

My CFO is someone who’s fully involved in my financial life.

He knows everything I spend on the personal side and everything that gets spent on the business side.

He’s a second set of eyes who knows where all the money’s going, so I don’t have to.

And I actually have another person who’s my financial strategist. This person is also fully aware of my spending but more so on the business strategy side, not so much on the personal side.

And let me tell you… Our finances have gotten a whole lot cleaner and a whole lot more stable since there’s been someone else looking at them.

Plus, it’s super helpful to have accountability for this financial stuff and someone who you can bounce crazy, MTV Cribs-like ideas off of.

Being Accountable

Everything starts by looking at the P&L at the end of every month.

If you’re not looking at your P&L every month and seeing the trends based on last year and based on the previous month, you’re going to harm your business.

And yes, it’s hard to confront this information. That’s why you need someone to hold your hand and say, “Hey man, we got to do this!”

But that’s why you have a CFO or someone to hold you accountable, because it absolutely has to get done.

Don’t let another month go by without taking action and confronting your finances.

Up Next: Money Talks (Part 3)

So far in this series I’ve shared my strategies for how I set financial goals to protect my business, and the reports I look at every month to manage my money and find potential problems.

In Part 3, I’m going to give you some practical tips for how to save more of the money you make and tell you why I believe it’s actually better to make money incrementally than all at once.

And lastly, I’m going to share with you the real questions I was asked when one of the largest companies in the world wanted to buy my business.

Knowing the answers to these questions will absolutely help you build a larger and healthier organization.